Scopes in the Greenhouse Gas Protocol and how do you tackle Scope 3 emissions

The European Union has increasingly put emphasis on sustainability, and simultaneously developed new directives and regulations in order to unite reporting on emissions. The European Union strives to align regulations to ensure comprehensive and comparable reports, taking into account not only the companies own emissions but also those of their respective value chains.

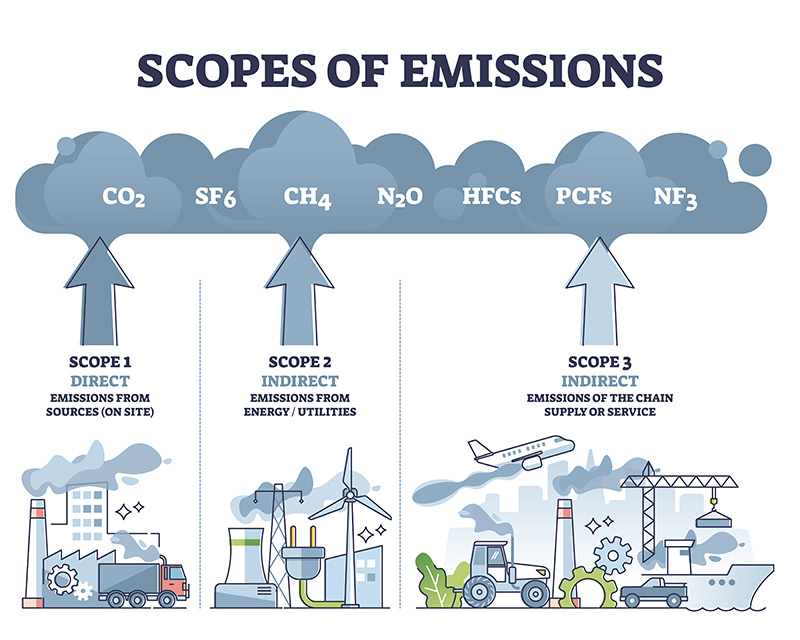

Breaking down the Greenhouse Gas Protocol

According to the most acknowledged emissions calculation method, called the Greenhouse Gas Protocol (GhG Protocol), companies should divide their emissions into three scopes. Calculations made in accordance with the GhG protocol can be viewed as an inventory of emissions, to understand which business activities have the most impact.

Scope 1: Covers direct emissions from the company, and include mobile and stationary fuel, emissions from industrial processes, and fugitive emissions. These emissions are related to buildings, vehicles and stationary engines that are operated by the company.

Scope 2: These are indirect emissions from purchasing energy generated outside the reporting company’s operations, such as electricity, heating, cooling and steam. These are areas that the company consumes and can control, but do not own and produce themselves.

Scope 3: This scope includes indirect emissions divided into 15 categories. Scope 3 is likely to cover 75-95% of the company’s total emissions. The 15 categories in scope 3 are intended to provide companies with a systematic framework to measure, manage, and reduce emissions across the value chain. The categories are divided to be mutually exclusive which will ensure that double counting of Scope 3 emissions are avoided for each company. Scope 3 emissions are associated with both upstream and downstream activities in the value chain.

These are the Scope 3 categories in order. Here are some examples of what activities are included in each category and should be counted as emissions in Scope 3 (and are not considered to be Scope 1 or 2 emissions).

1. Purchases of Goods and Services:

- Purchasing of office supplies, food for the canteen, goods to be sold to end-users or materials for production such as timber.

- Purchasing of data storage, cleaning services, and other services.

2. Capital Goods:

- Purchase of equipment, machinery, buildings, facilities, and vehicles used to manufacture goods or provide a service.

3. Fuel and Energy related activities:

- Mining of coal

- Refining of gasoline

- Transmission and distribution of natural gas

- Production of biofuels

4. Upstream Transportation and Distribution:

- All purchased transportation and distribution services.

- Transportation of purchased goods from 1st tier suppliers.

5. Waste:

- Waste generated in day-to-day operations such as organic waste, general waste, plastic etc. Additionally, includes the emissions from treatment relating to if the waste is recycled, incinerated or goes into landfill.

- Wastewater from operations.

6. Business Travel:

- Distance traveled by employees in different means of transportation such as flight, taxi, train etc. for business purposes.

7. Employee Commute:

- Distance traveled by employees between work and home by bike, public transport, car etc.

8. Upstream Leased Assets:

- Rented office spaces or leased company cars.

9. Downstream Transportation and Distribution:

- The commuting of customers to and from the reporting companies stores.

- Last mile delivery purchased by customers.

10. Processing of Sold Products:

- Processing of glass (intermediate product) to make wine bottles (final product).

11. Use of Sold Products:

- Electricity consumption of sold electronics over their expected lifetime.

- Fuel consumption of sold vehicles over their expected lifetime.

12. End-of-life treatment of Sold Products:

- The glass jar is recycled whereas the plastic label goes into incineration.

13. Downstream Leased Assets:

- Energy consumption in buildings rented to other companies.

- Fuel consumption of vehicles leased to other companies.

14. Franchises:

- The franchisor, the organization granting the license, should report the Scope 1 and Scope 2 emissions of franchisees.

15. Investments:

- If the company has invested 10% in a company, this company is responsible for 10% of that company’s emissions. Financial institutions additionally have to include emissions from commercial loans, mortgages, project financing etc.

How to tackle Scope 3:

Understanding the most important emissions in scope 3:

Start by going through each Scope 3 category in the GhG Protocol. Understand which are related to the company’s operations and write them down.

Make a priority list:

The categories should be ranked, in order to understand their importance. It is preferred to rank the categories by making a rough estimation of their CO2 emissions, by using a spend based method or an estimation of amount/units bought and multiply these with some CO2 coefficients you can rank them according to percentage of the company’s CO2 emissions. However, if you are unfamiliar with this then the categories can also be evaluated on several other parameters to get an overview of their importance; such as the amount of units bought, the influence it has on operations, the risk it poses or simply the categories with the most spending. Once you know which are the biggest or most important categories, it can help the process to move forward by selecting which ones are also the easiest to start with. You want this step to result in a priority list that balances impact of emissions and feasibility of collecting the data.

Decide on the methodology:

Each category in Scope 3 might require different data collection methods. Which methodology you choose depends on availability of data as well as quality and accuracy desired. Generally, you will choose an activity based approach if you want higher quality and more accurate accounting, whereas spend based data is more of an estimation but also easier to handle and collect. The decision should be based on the time frame for collecting data and how many categories you want to cover.

Make a roadmap:

Once you have a clear picture of your categories you have to decide if you want to focus on the biggest category first, or go for the low hanging fruits. The general recommendation would be to focus on one or a few categories at a time and make a roadmap for which categories you want to include for the next report. For banks it can make sense to only focus on category 15, the investments, as they can be 90% of the company emissions. However, if the biggest category requires extensive work and there is a limited time for collection of data, it can make sense to start with some smaller and easier categories. Although the bank’s smaller categories might only cover 10% of emissions for now, it will be a chance to learn how to approach different types of calculations for next year's reporting, and therefore be a good start as well. Trying to do everything at once might result in bad quality data or work overload.

Do transparent reporting:

If you do not have all data needed, or there are any doubts in the data collected, then the best thing is to make notes and tell the truth. It is okay if you do spend based reporting, or if you can only collect data about some of your purchased products and services. However, you have to be honest in your reporting about this and let the readers know the scope and quality of the data collected.

Correct data management can help you to get started or refine your GhG accounting. Klappir has a lot of experience in collecting, analyzing and creating reports from high-frequency data on CO2 emissions.

Share article